Thank you so much for your interest in my 10/23 post! Some feedback has been that it could be paired down (true story – it was weeks of research and concern that came out in a big, hurried blob – sorry?!). I have answered the question I have been getting asked about what I mean by “purple,” and I’ve narrowed down the discussion to the economy for now since that seems to be the hiccup that inquiring minds want to talk about. I left the original post up for those of you who want the deep and convoluted dive!

WHAT IS PURPLE?

When I say I consider myself purple, I mean that I have a mix of traditional conservative and traditional progressive thought processes and values that make it hard to shoehorn myself into a party. To list a few: I have guns and support gun ownership, but I also support sensible legislation that promotes and ensures safety. We aren’t religious but we have clear morals and values at our foundation that shape our priorities – and they don’t bend to rationalize the behavior of politicians or turn blind eyes to expedite their power. I am an MBA with enough respect for history and its tendency to repeat to support both the power of capitalism and the guard rails that must keep it honest and working not for just for elites, but the broader population. I believe that immigrants tend to be good, hard working people who often appreciate what our country has to offer more than some of us who’ve been here a lot longer. I support changes that create legal pathways to citizenship for both new immigrants and for children and others who have been here their entire lives and would essentially be foreigners in their native countries if deported. I think “the wall” and “mass deportations” are expensive and ineffective rhetorical distractions from doing the bipartisan work of reforming immigration policy – but that doesn’t mean I think we should have open borders and freebies for all. I believe in the truth, the rule of law, the constitution, and in democracy – but that doesn’t mean I don’t recognize the flaws that make those things imperfect.

WORRIED?

Chances are, if you’re taking the time to read my thoughts, you have concerns about Trump’s fitness for the presidency and perhaps skepticism about what a Harris presidency would mean for you financially – based on the questions I keep hearing. You may feel unsure about whether your concerns about Trump are true or exaggerated (can he really be that bad?) and it may be hard to know where to begin fact-checking because the political noise is so overwhelming. You may feel conflicted about whether those concerns outweigh your priority of economic and financial stability – a topic for which the Republicans have loudly claimed authority. You might be thinking that inflation, cost of living, interest rates, and the like are a weakness of the current administration and a liability for a Harris presidency. Combined, these make for a lot of apprehension about who to vote for.

ECONOMY?

If the economy is the elephant in the room for you, I think the information below will be a relief. Summarizing all the information and resources I’ve reviewed; I strongly believe that our economy today would look the same regardless of who became president in 2020 and that the best and most centered resources validate the stability and relative accomplishment of today’s metrics and point to much greater stability and prosperity with Harris’s economic ideology and plans. If your apprehensions are heavy with these economic worries, I think this summary and the low bias resources I cite throughout may help to unburden you.

You’re not wrong, your money went further before 2020 and you’re entitled to be salty about it – but the reasons need to be examined more closely. Pandemic issues, decisions, and supply chain problems were not party specific, or even country specific. Both presidents spent trillions on relief packages to avoid recession and depression worries, and neither of executed perfectly. Getting congress to agree on anything, and making the choice to avert an immediate crisis while accepting the unknown future consequences is what they both did and would do again. There was no perfect solution or guarantee of success to be made.

The difficult stimulus decisions that stoked the economy and prevented high unemployment also caused it to overheat, driving inflation up as demand outpaced supply for literally everything. The conflict between Russia and Ukraine further disrupted norms and impacted global economics. It is uncomfortable but normal and not at all unprecedented for economies to recalibrate as domestic and global challenges arise.

To that end, I would argue that inflation is not a flaw of the current administration but a reckoning on the road to recovery from a global pandemic. If Trump had won in 2020 he would have most certainly made similar stimulus moves to avoid recession and the numbers would look like they do today. On the flip side, looking a recession in the face would have instead sparked high unemployment resulting in low demand, low purchasing power, more business closures, low wages, reduced house equity and values, and turmoil in financial markets. The choice was clear and would have been for Trump too – but it’s much easier to run for election as armchair quarterback in hindsight and pretend otherwise.

- This link to US Inflation statistics for the last 100 Years clearly shows inflation has been a lot higher and taken longer to overcome during several historical timeframes.

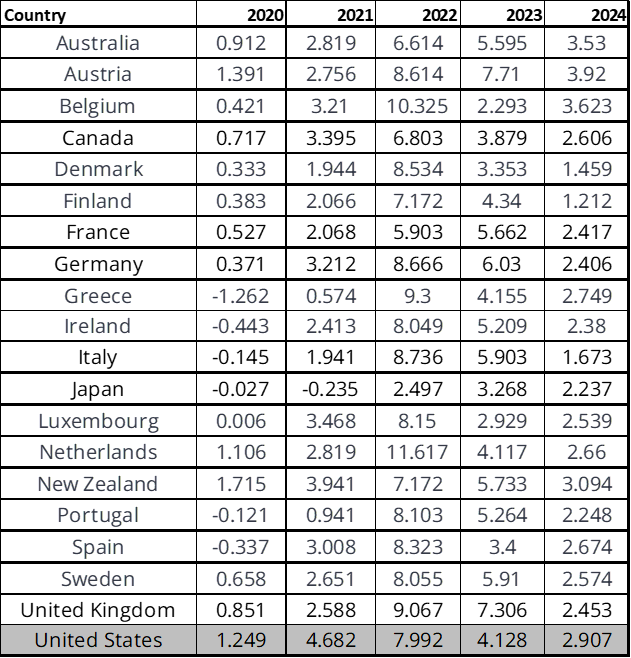

- This link to global inflation statistics from 2020-2024 (May) tells the story of how every country’s inflation weathered the pandemic upset. Below, I sorted for the developed countries we often benchmark with for a quick view – clearly showing that ours has not been unusual or unprecedented. As of October, The US is at 2.4 and trending down toward the goal of 2%.

The US economic snapshot is envied by other developed countries. Inflation of 2.4% is at the same level as it was right before the pandemic, GDP growth is at a remarkable 3%, unemployment has been under 4% for 3 years, The Fed is cutting interest rates, and there are 7M more US jobs than pre-pandemic. It looks strong in every category EXCEPT income inequality which is high compared to other G7 countries. More and more of the country’s wealth has been concentrated to the top (much like the pre-depression era) with 67% of the total wealth of the US population being held by the top 10% of earners. Check out these Trends in income and wealth inequality.

If I could venture some guesses as to why sentiment is poor even though metrics are strong, they would be these: There are too many conflicting and biased partisan reports to be confident in what is real; they all sound plausible and it’s exhausting. Centered sources aren’t clicked as often because statistics and well-cited sources aren’t as sexy and entertaining as angry influencers and memes that seem to hit the bullseye so easily. Maybe we enjoy our feelings being vindicated a little bit and tend stop looking once we get that hit of perceived confirmation and rationalization.

Grocery prices: It’s unlikely that grocery prices would be lower if Trump had remained in office. Higher costs are also a product of economic recovery, and a host of other factors for which there is little short-term control to be had. Things like fires, droughts, hurricanes, avian flu, and war can wreak havoc on supply & demand. How Food Prices have Changed Over the Last 4 Years. Russia & Ukraine impact on global food supply

Fuel Prices: Presidents don’t have much to do with the price of gas which is also a product of supply and demand. It is a convenient statistic to spin to one’s advantage on the campaign trail since it affects almost everybody. Understanding “energy independence” is in comparison to how it’s portrayed politically is also important. The reality of it is that the US can’t use a lot of what we produce and it’s used for exports because our refineries were built to work with lighter oil than what we can drill for. Did you know that US production of oil is at record highs under the Biden administration? Finally, comparing gas prices in 2020 to today is apples and oranges. Gas prices were low in 2020 because there was no demand for gas as we sat around at home with nowhere to go. Current fuel price outlook. Oil Price Slides amid China Slowdown

Housing / Interest rates: The Federal Reserve, “The Fed,” handles a slew of things – interest rates being the most well-known. It is independent, and by design, answers to congress and not the president. Since 1913’s Federal Reserve Act, the board (confirmed at different intervals) are nominated by the president, confirmed by the senate, and sit for 14 years. The idea is not to be beholden to political whims, but to do the work of maintaining economic stability.

Raising interest rates is an effective (but not enjoyable) tool to reduce demand by consumers and businesses and manage inflation. When borrowing is cheap (low rates) inflation can soar with demand. When borrowing is expensive (high rates), markets can cool to a more sustainable clip. For example: low interest drove demand for housing which caused the cost of labor and materials to rise as urgent consumers wanted to build homes faster than supply would allow. The opposite is where interest rates are high enough that they delay or deter buyers which slows demand and helps bring the cost of labor and supplies to a level that aligns closer to actual value. Too low and inflation skyrockets. Too high and we risk unemployment and stagflation. Make no mistake, it’s a tightrope no one wants to walk. ALERT: The next president will appoint the next Chair to the Federal Reserve. A red flag to take note of is that Trump would like to dilute the independence of The Fed and have it answer to him and Project 2025 calls for eliminating The Fed entirely.

Tariffs: Experts agree that Trump’s proposed tariffs do not punish foreign suppliers, his prior tariffs have punished and are likely to continue to punish American consumers. The added costs are not typically absorbed by the supplier – they are absorbed by the consumer who pays a higher sticker price because the goods would be more expensive for the manufacturer to acquire. The exceptions would be where a tariff discouraged foreign supply in support of a domestic company that could then become the supplier with less competition from abroad. Or, if the foreign supplier were desperate to unload supply they could, in theory, lower their price. Evaluating how the tariffs would benefit or hurt the US is important.

Trump imposed tariffs on steel for China which was a good idea because China was flooding the international market with cheap steel that was causing US manufacturing woes. However, China circumvented these by sending it to Mexico first and the cheap steel continued to hurt US manufacturing and didn’t penalize China as hoped. In May 2024, Biden closed the loophole on this by increasing restrictions on imports of steel to include language to prevent China from being able to use Mexico as a middleman.

Trump/Biden spending comparison: In addition to the challenges of recovery, deficit spending drives inflation. Trump, Biden, and Harris are all guilty of proposing costly ideas without being transparent about the costs which contribute to the problem as the government borrows more money to pay for it at higher rates. The US can reduce debt and deficit by increasing taxes and/or by cutting spending – (neither of which are popular among voters) but it can’t spend more and cut taxes without consequence. It’s ok that it’s complicated – let’s just be transparent about it. Check out this comparison by Committee for a Responsible Federal Budget and this article on Deficit Spending from Reuters.

Trump’s biggest accomplishments were corporate tax cuts, environmental deregulation, and changes to global agreements on climate. These may be perceived differently by red and blue. How America Changed During Trump’s First Term by Pew Research shares tons about accomplishments and statistics. Here are 30 Things Donald Trump Did as President You Might Have Missed some good, some not good.

Biden’s biggest accomplishments didn’t get the sexy headlines that corporate tax cuts did – but there were lots of small legislative wins in things like predatory lending, junk fees, insulin caps, airlines paying consumers when they goof up, etc. and then there were big ones like incentivizing semiconductors to be made domestically, hitting the highest domestic oil production in history, and the Inflation Reduction Act. Here are 30 Things Joe Biden Did as President You Might Have Missed.

Trump/Harris plan comparison: Both have plans that add debt, but the estimated cost of Trump’s top heavy plans double Harris’s adding 7.5T versus 3.5T.

Harris’s history, plans, and focus are described online HERE. Much of what she hopes is dependent on a legislative body in agreement. PBS and BBC provide their synopsis as well. BBC shared where Harris stands on top issues. Here is Harris Versus Trump on the Economy from Forbes.

Trump runs light on policy specifics and heavy on opponent attacks in Agenda 47, and (although trying to distance himself) is tied to Project 2025 which is a 900 page document written by the Heritage Foundation, Trump allies, and Trump’s former White House officials, with by JD Vance authoring a Forward to the author’s new book. It is a blueprint for an incoming Trump presidency that discusses numerous topics – the most concerning are: Placing under executive control many agencies (including DOJ which is independent today), having the Dept of Health and Human Services be more “biblically based,” eliminating the Dept of Education, increasing abortion restrictions, mass deportations (even people here legally), and removing renewable energy efforts. TIME is considered slightly left leaning, interviewed Trump twice, and came away very concerned. Trump’s proposed tax cuts

Economic ideology: Trickle down and trickle up are talking points that describe how taxation and policy can affect individuals. Here is a synopsis by the Economic Policy Institute that compares 50 years of results by political party. What is middle class and the state of the middle class?

Trickle down or supply side economics is an interesting theory, but after 40 years, most reputable data tends to give it a thumbs down suggesting that it has redistributed and concentrated an enormous amount of money to billionaires with little benefit to average Americans or middle class. The state of the middle class seems to support this opinion.

Cutting taxes on corporations and wealthy tends to explode deficits and trickles money to the top. The government borrows and takes on federal debt (for which the American people are on the hook) so that businesses (and or wealthy) do not pay which is spun as incentive to spend that savings on their businesses, goods, and services that trickle down and positively impact middle and lower classes. The government could enact policy that would force companies to spend at least some of that tax savings on employees and infrastructure – but because they don’t (since that would be considered overreach), companies who could trickle it down have no incentive to do so and tend to use it to buy back their own stock or give execs enormous bonuses. Stock buybacks are alright for people invested in the stock market – but for the people who need relief from day-to-day costs and not just a spike in 401k, this is not effective. The Great Depression is a real-life example of a supply side trickle down failure that could not be rescued by demand from everyday people because there was no wealth held among the majority of Americans after having a huge and disproportionate amount held by the mega-wealthy disappear. Trickle down is a Myth Effects of Trump tax cuts 2017

Trickle Up – or demand side economics is also an interesting theory that is less studied and reported on because until recently, US policy hasn’t encouraged it in several decades. It was successful post WWII and is being put to test now with The American Rescue Plan. It suggests that domestic investment not in tax cuts for wealthy but in infrastructure, schools, airports, shipping ports, etc. where American companies do the work would put dollars in lower and middle class hands while also creating jobs.

Here is a 2020 Article from the Guardian discussing the history and merits. The Guardian leans left and the author of this is Robert Reich who is very well respected but is considered left-thinking. Rescue plan opinion – The Hill

Market Strength: Markets enjoy, prefer, and perform under political stability. Laws facing precedent changing, threat of government shutdowns, legislation flip flops and disagreements, refusal to transfer power peacefully, global conflicts, trade wars, and angry allies are all examples of problems that cause market volatility because they disrupt the confidence and ability of corporations to plan, take risk, and execute ideas, borrow money, hire people, innovate, and expand. Market stability is a critical priority for economic health. In fairness, I have to say that they also love deregulation – but the hefty bill for that always comes in at some point (For example, the Depression and the 2008 banking and housing crisis).

Debt Ceiling, Federal Deficit, Federal Debt explained: Federal Budget Process “The National Deficit” is the amount spent above and beyond what is being collected in a given year. “The National Debt” is the total amount the government owes from past and current deficits.

“The Debt Ceiling” is NOT a cap on spending as some mistake it to be (and others pretend it to be). The money has already been spent. When the US spends more than the budget forecast, it must borrow money to make up the deficit (shortage). That borrowed money adds to the national debt for which there is a ceiling in place that congress increases to avoid defaulting on our loans. If they vote not to raise the debt ceiling, it means a vote not to pay our creditors and would put the US in default. As the stable powerhouse of the world, being in default would have pretty catastrophic effects from markets plummeting, interest rates rising, SS, Medicare, Military benefits all going unpaid causing mass poverty… it’s bad. Politicians pretending to stand up to the spenders in DC by threatening shutdowns and default are manipulating people who do not understand the debt ceiling for their own optics and shenanigans. They are either hoping that fallout gets blamed on the political party in power making them look heroic while the other guys look like they destroyed the country… or they are posturing to attach some kind of extreme and unrelated legislation to the vote by holding it hostage and whipping up the media.

Spending less than we bring in is an obvious solution. That has to do with taxation as much as it does spending. There are lots of ideas to hash out to balance the budget, but using the debt ceiling as a political weapon is a dangerous plan. Here is a libertarian plan for balancing the budget – I don’t agree with A LOT of what’s in here and you probably won’t either. What it’s good for is reviewing the difficult decisions of a huge country.

SUMMARY

My intention when starting this was to provide links to sources that found merit in the prior and proposed Trump strategies, but in reality it was very difficult to find centered praise free from hyperbole and rhetoric or approval not written by the very politicians who made the policy. Google “did the 2017 tax cuts work” to see what I mean. If you have sources that say otherwise to share, please do! I would like to give balance to my opinions. But also, please fact check and bias check the source first.

The evidence supporting the health of our current economy along with the analysis of the proposals by Trump and Harris solidified my opinion that the state of the American economy is in better shape than sentiment suggests and that we will be in better hands if Harris is elected. There are several other reasons I believe Harris to be the best choice, but in the interest of focusing on what is important to the people doing the asking, I’ll keep it to the economy on this one.